Legal Aspects of Getting Paid in Crypto

Photo from Pexels

A fundamental aspect of commercial contracts is getting paid. Professional services are rendered for a fee. Products are sold for a price. Products given for free are called a gift. Services rendered for free are volunteer work.

It is safe to say people work because they want to get paid. Whether for a salary, or a commission, it is a question of payment. Some want to get paid in kind, but most want to get paid in cash. The common expectation is that, they are planning on getting paid.

Crypto Payments and the Lawyer

As lawyers in blockchain, we offer the option of payment in crypto. Whether in Bitcoin, or Ethereum, or a stablecoin like USDT, we are open to getting paid in crypto. Clients rich and awash in Bitcoin, can pay us in Bitcoin. So, too, can clients who want to reduce remittance fees.

We offer that option because Bitcoin was created as a means of payment. It was meant to be electronic money, without intermediaries. The abstract of Bitcoin’s white paper begins thus: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

Money, as it happens, comes in many forms. As many as the languages and cultures upon the face of the Earth, so too are the many forms of money. From cowrie shells to large rocks; from shiny diamonds to printed paper; as long as society’s norms recognise something as money, it is accepted as such.

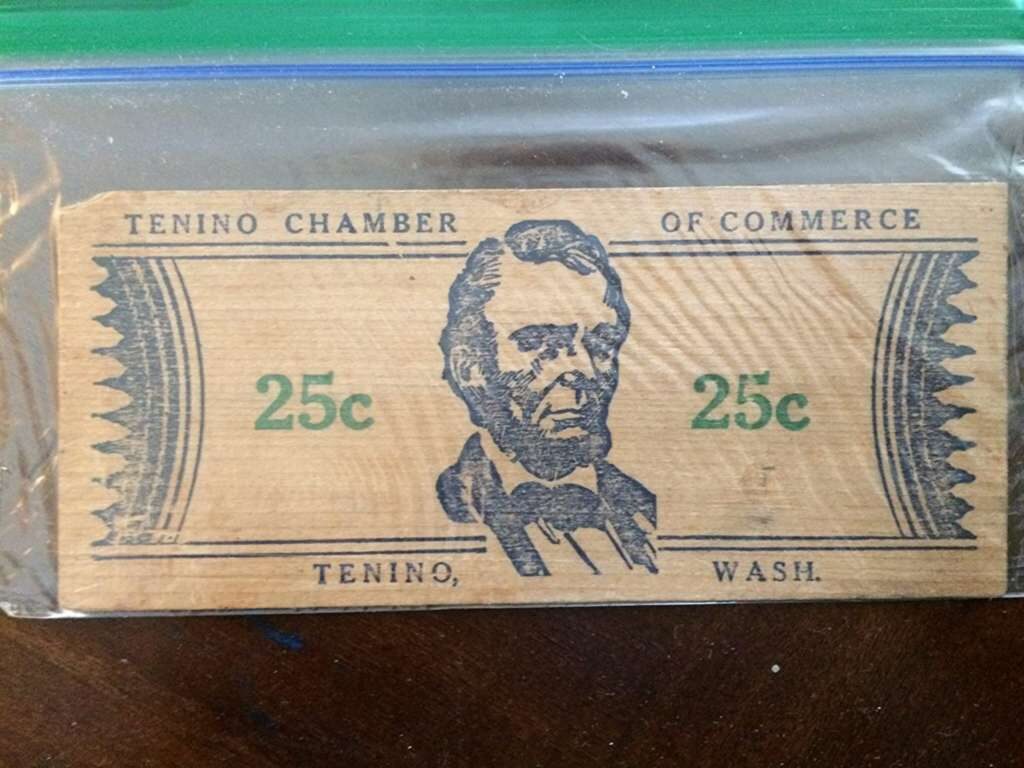

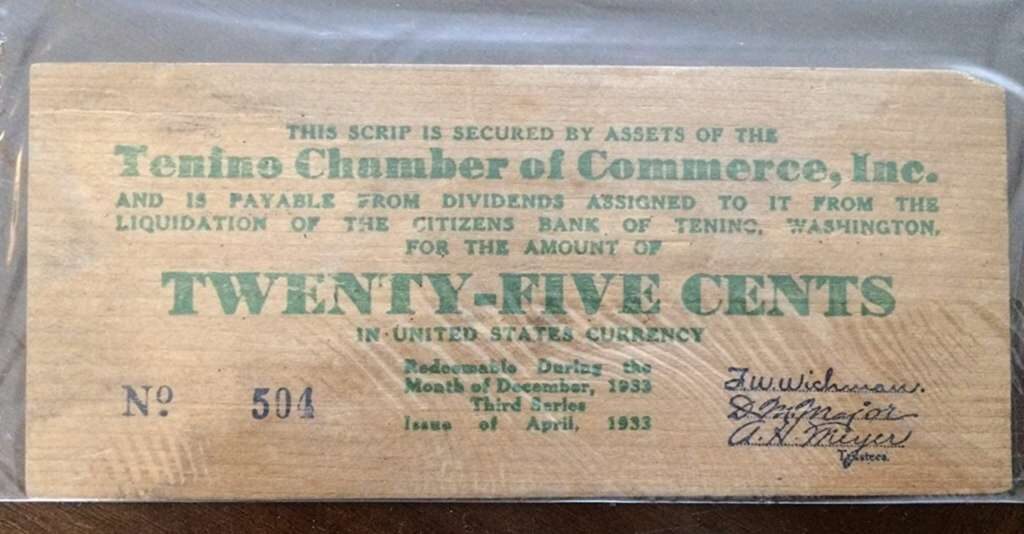

In June 2020, due to cashflow issues caused by COVID19, a small town in Washington, USA, called Tenino, issued wooden currency tokens as a means of payments. Since the wooden currency is only recognised in Tenino, it also helps stimulate the local economy. Each token is worth $25, and is made of wooden veneer.

It’s not a new idea. During the Great Depression in the 1930’s, the town of Tenino also issued wooden currency notes, called a scrip (or an alternative currency). It bore the face of Abraham Lincoln, instead of George Washington.

Coming back to our topic, there are a few legal issues with getting paid in crypto. We hope to address some of these issues in this article.

Is Bitcoin Money?

A fundamental question is whether cryptocurrency can replace fiat as consideration to effect payment. Put another way, is crypto money? Or, in yet another way – is crypto legal tender?

If something is legal tender in a certain country, you have to accept it for payments in that country. At the same time, you can also use it to pay others in that country.

Many jurisdictions disclaim that Bitcoin is legal tender. “It is not legal tender,” a central bank has warned, “and you are therefore urged to exercise caution when dealing with it.”

Saying that Bitcoin isn’t legal tender, isn’t the same as saying that it is illegal. It just isn’t recognised for payment. (If it is illegal, it would be contraband, and you could get thrown into jail for it.)

In January 2014, the central bank of Malaysia said, “Bitcoin is not recognised as legal tender in Malaysia. The Central Bank does not regulate the operations of Bitcoin. The public is therefore advised to be cautious of the risks associated with the usage of such digital currency.”

Four years later, in 2018, the central bank of Malaysia reiterated its stance that digital currencies are not legal tender, but issued anti-money laundering guidelines — the Anti-Money Laundering and Counter Financing of Terrorism Policy for Digital Currencies (Sector 6).

Picture Source: Pexels

For Malaysia, at least, Bitcoin and other digital currencies remain non-legal tender, but anti-money laundering measures must be taken.

Upon deeper reflection, if Bitcoin is not legal tender, then it is not money. And if people are not dealing with money, then why do anti-money laundering rules apply?

The answer may be, because Bitcoin, and other digital currencies, resemble money. It’s fungible, divisible, readily available (as long as you have cash to purchase it). It may even be better than money, in that it is traceable, tamper proof, indestructible, verifiable, and secure.

And as long as you can pay for things or services with crypto, isn’t it as good as money?

But another answer may be, because Bitcoin offers great liquidity, it’s easy to convert cash into Bitcoin, and then, at some other date, convert it back to cash. It’s the perfect remittance solution: Blockchain transactions can be verified within minutes.

That uncanny ability to change forms like a shapeshifter, get beamed around the planet, and shapeshift back to its original form, potentially makes crypto a vehicle for shifting money around.

But that type of transaction, known as “layering” in anti-money laundering terms, could also apply to purchases of art, diamond rings, landed property, and expensive vehicles. It’s a whole range of products that can be used to launder money, not just crypto.

So, crypto may not necessarily be legal tender, but you should adhere to the anti-money laundering guidelines.

One good reason that countries would be hesitant to recognise cryptocurrencies as legal tender: Many cryptocurrencies, with the exception of stablecoins, tend to suffer from extreme volatility.

Should you be taxed?

Now, we are lawyers, not tax consultants. So this part of the article comes with a caveat: Check with your accountant.

Logically, however, if cryptocurrencies are regarded as income, then you should be taxed.

But if cryptocurrencies are not regarded as money, then the acquisition of cryptocurrencies should not be regarded as income.

It could however be regarded as an asset on your balance sheet. Since such assets do have a market value (which fluctuates), a value can be assigned to the cryptocurrencies in your possession.

When you liquidate such an asset, you receive cash – which represents income. In such a circumstance, you should be taxed.

It’s like your customer decided to pay you in rare comic books – can you get taxed for that? Probably not, but you would certainly be liable to pay tax when you sell your rare comic books!

How do crypto refunds work?

So, imagine two scenarios. Both equally apply to receiving payment in crypto.

Scenario one, you sell a car for a certain amount of cryptocurrency. Overnight, the value of the cryptocurrency shoots up, through the roof, and right to the moon. Your buyer, obviously a man of discernment, decides in that moment that there is something wrong with your car, and demands for his cryptocurrency to be refunded.

Scenario two, you agree to do a certain job for the next twelve months, and your client pays you in advance in cryptocurrency. (In Bitcoin, no less.) Three months down the road, your client passes away, and his widow asks for a refund. Unfortunately, the value of the cryptocurrency has plummeted, so she pleads that she is a technophobe and demands repayment in US Dollars, based on the cryptocurrency price of three months ago.

One workable solution would be to stipulate the terms governing any refunds for payments made in crypto. A refund clause should protect you if it states that:

- You have the sole right to choose whether to refund in fiat or in cryptocurrency;

- Calculated based on the price of the cryptocurrency at the time you received payment;

- With adequate provision for pro rata.

With such a clause, you could refund in the crypto tokens that you have received; or alternatively, make a refund in fiat currency.

Another workable solution would be to require that crypto payments be made in stablecoins, such as USDT. That would completely remove the risk (and excitement) of currency fluctuations.

A point that must be noted: Monies paid to you for an outright sale, represent your earnings. Monies paid to you for future services, remains the property of your client until those services are performed.

In the same way, cryptocurrency paid to you for an outright sale, represents your earnings. But cryptocurrency paid to you for future services, remains the property of your client until those services are performed.

If a part of those services are no longer required, it seems fair that you refund a portion of the funds that you have received. Otherwise, it may be a case of unjust enrichment, or conversion of property.

Conclusion

This article hasn’t completely addressed the legal issues in cryptocurrency payments, but it’s a start in the right direction. Hopefully there will be an opportunity for a follow up article.

Thanks for reading! Please share this article if you found it useful.

Important Notice

This article is prepared for general information only. It is not intended to constitute legal advice, and your case may be unique. Please consult with your lawyer or someone of a similar standing before relying on any statement contained in this article.