Is My NFT a Security?

Most people would not expect NFTs to be deemed a security. Leading securities enforcement agencies have yet to inspect NFTs as securities. But the evolving game plan for NFT projects show that the popular NFTs of tomorrow may be deemed as securities.

Most NFTs are Not Securities

In a previous article, I wrote about the use cases of NFTs. In many cases, the NFT is sold to you merely as tokenized art: The NFT buyer buys nothing more than media which has been tokenized. And in that case, the situation is clear: There is no security to speak of.

In other cases, the NFTs have “utility”, which is another way of saying that there are benefits attached to ownership of the NFT. The NFT allows its holders, among others, access to community; access to software, games, and experiences; free merchandise; and others. In such cases, the NFT may be a “utility token”, where its utility is derived from the benefits that the token holder enjoys.

However, Some NFTs Are Securities.

The NFT which rewards you with tokens

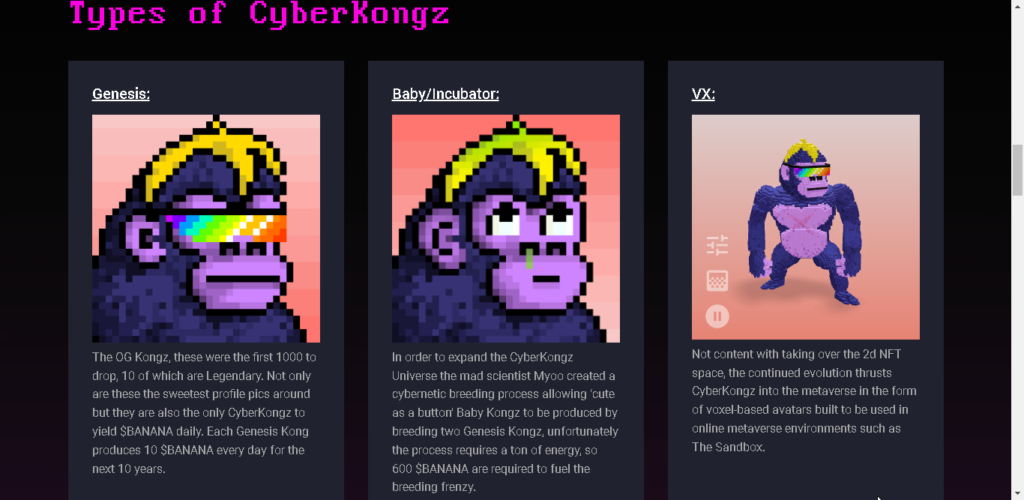

The first type of NFT that could be a security is an NFT sold with the expectation that it would generate a token. It does not matter that the token generated is a “utility token”. If that token has a monetary value, the NFT would fulfill the definition of a security under the Howey Test. An example of this may be the CyberKongz NFT, which gives its token holder $BANANA tokens daily, as a reward for doing nothing more than to hold the CyberKongz NFT in their wallet. Another example may be the Mutant Cats NFT, which rewards its holders with $FISH tokens when they stake it.

For those wondering, the Howey Test is a popular framework enunciated by the American courts, in which was defined what is a security, or an “investment contract”. Its requirements are that there is (a) an investment of money; (b) in a common enterprise; (c) with expectation of profit, from the efforts of others. (You can read the US SEC’s guide, “Framework for Investment Contract Analysis of Digital Assets“.)

Let’s try to apply the Howey Test to the NFTs just described. Was there an investment of money? Yes, there was. Is there a common enterprise? There is. And is there expectation of profit? Yes, when the NFT starts airdropping the tokens on a daily basis, there will be.

When the NFT is sold (during minting) with the expectation that there will be an airdrop of tokens, the expectation of the tokens fulfills the “expectation of profit” limb.

The NFT which rewards you from business profits

There are some NFT collections which promise to reward you from the business profits. When that NFT is sold, it fulfills the criteria to be defined as an “investment contract” under the Howey Test: You pay money, so that the NFT seller can use it to do business, and return you a part of the profits he earns from his business.

An example of this type of NFT is the JAWS NFT project. They are trying to sell an NFT collection to fund a Bitcoin mining project. Thankfully, they are aware that their intention to return profits to their collectors would turn the NFT into a security, so, they have reserved only 2,222 pieces for “high rollers” at 4 ETH per pop! They have also decided to work with a law firm to ensure that their “high roller” NFTs are compliant with securities laws.

ApeCoin Case Study & Sufficient Decentralization

If you are thinking of releasing a token via an NFT, it may not be the best idea to make it part of your NFT’s advertising. You might want to follow the ApeCoin, and announce it way, way later after you have sold out your NFT collection. Otherwise, the token which is airdropped for free to NFT holders may be seen as part and parcel of the NFT, and thereby justify that there is an “expectation of profit”.

In the case of the ApeCoin, there are several clever moves. First, the sale of the NFT collections (BAYC / MAYC / BAKC) has long ended, so there is no way an allegation can be made that the NFT was sold with the promise of a free token. Second, they took steps to set up a DAO and a foundation, and a board of trustees / advisors / governors, possibly in an effort to claim sufficient distance from Yuga Labs LLC, and to establish sufficient “decentralization”.

Incidentally, the “sufficiently decentralized” doctrine, coming from William Hinman, can be summarized with this quote: “If the network on which the token or coin is to function is sufficiently decentralized – where purchasers would no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts – the assets may not represent an investment contract.”

This same argument was incidentally raised in Ripple v SEC, an on-going case, to justify that XRP is sufficiently decentralized, and is therefore not a security. But we digress.

Conclusion

It is safe to say that in an overcrowded, oversaturated NFT marketplace, projects try to stand out. However, sometimes the method they use may inadvertently turn the NFT into a security. It pays to be safe rather than sorry, and to be sure that the regulators do not come knocking on the door.

Disclaimer

This article was written for general information and should not be treated as legal advice. In the event you are trying to launch an NFT and you are worried that the NFT may be a security, please get in touch.