Can crypto help your business survive COVID19?

Introduction

The coronavirus has a bad impact on businesses. In this article we explore whether crypto can help businesses survive the COVID19 pandemic. We touch on e-commerce, crypto payments, and issuing tokens via IEO.

Coronavirus and the cashflow problem

Traditional brick-and-mortar businesses depend on customers walking in. But the coronavirus makes it difficult, even dangerous, to patronize traditional businesses. Customers are afraid of COVID19, so they stay away.

No customers, means no income. Cashflow becomes a problem. Businesses will see cash reserves dry up. And before long, it’s time to call it a day. Some businesses have taken pre-emptive measures and have decided to close down. Here are some examples.

HOTELS: G City Club Hotel, located nearby KLCC in Kuala Lumpur, announced its decision to cease business due to coronavirus. Other hotels have followed suit, such as the Syeun Hotel in Ipoh, Kinta Riverfront Hotel & Suites in Ipoh, and the Ramada Plaza in Melaka.

RETAIL: Many small retailers are expecting to close shop.

MASSAGE: A massage center warned of an “unhappy ending” if it cannot resume business.

The world economy was slowing down in 2019, but the coronavirus has brought it to a screeching halt.

The e-commerce edge

During this economic downturn, e-commerce seems to be doing well. Millions of bored people under lockdown are clicking “Buy Now” and driving billions of dollars in online sales.

E-commerce is the perfect, no-contact business. Its sales continue to thrive amid the pandemic.

With some saying that the coronavirus would be around for two years, it seems a good time to get into e-commerce.

Getting into e-commerce with crypto

At its very basic, e-commerce requires nothing more than a social media account, and a bank account. Bloggers and social media influencers often advertise their products on their social media accounts. People who are interested can make an order, and bank in the money. Once payment is made, goods are posted out.

But social media based selling can be tedious, especially when orders boom. It’s wiser to sell through an e-commerce store. There are now many platform providers out there: Shopify, BigCommerce, and others. They offer their users the ability to set up e-commerce stores quickly and easily. Payments can be processed easily through these platforms.

One relevant question is, can crypto help businesses break into e-commerce?

The answer is maybe. Here’s why.

Blockchain-powered e-commerce

If you’re thinking about opening an e-commerce store on a blockchain-powered platform, it may be a challenge to get traffic. As a result of poor traffic, you will also suffer from poor sales.

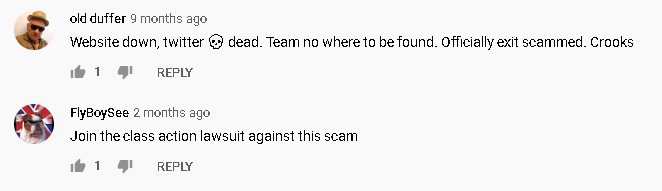

Some “blockchain-powered” e-commerce platforms have also closed down since their tokensale, so that should give you an idea. For example, Storiqa, a “smart marketplace powered by blockchain”, raised $25 million during its 2017 tokensale. Its YouTube channel features various interviews right up to 2019. Yet today, its website is offline.

Here are some comments from the video above, presumably from folks who contributed to the $25 million tokensale.

Today, the former CEO of Storiqa is the Chief Strategy Officer at Quppy, without any trace of his former links to Storiqa.

That is not to say that all blockchain-powered e-commerce platforms are likely to suffer the same fate. My only gripe is that a startup that raises $25 million in tokensales ought to last a little longer.

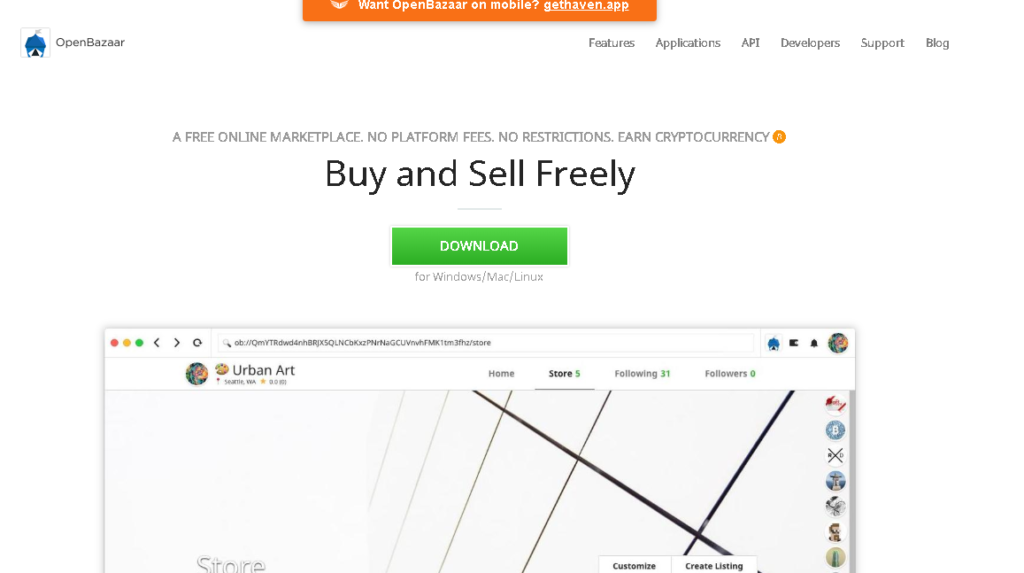

Among the other players in blockchain-powered marketplaces, I’m quite hopeful for OpenBazaar. It announces itself as a “peer-to-peer online marketplace”. There’s a quote of approval from the great Andreas Antonopoulos on its front page. There’s also security features and dispute resolution through multisignature escrow.

Accept payment in crypto

If, you are thinking of accepting crypto as an alternative payment for your online business, you might be on to something good. Crypto payments can be helpful, provided you choose the right kind of crypto. (Try to lean in favour of Bitcoin or Ethereum.)

Accepting crypto might benefit you in one of the following ways:

- The crypto you accept as payment can be exchanged for cash (fiat currency)

- The crypto you accept as payment may be used as payment for your own purchases

- The person paying you in crypto can send payment easily, especially if he or she doesn’t have access to banking facility.

Some online services allow you to receive Bitcoin as payment, such as Bitpay, CoinPayments and Coingate.

But, having said that, there may be legal issues in receiving payment in crypto. For example, Malaysia’s Payment Systems Act the central bank may prohibit the issuance of a payment system (section 23), or designate a means of making payments as a “payment system” for purposes of safeguarding public interest (section 24). Issuance of payment systems without the central bank’s approval, are prohibited (section 25).

In 2018, the founder of a “crypto mall” in Penang was fined RM5 million for infringing section 25 of the Payment Systems Act.

Arguably, if you accept a pre-existing cryptocurrency like Bitcoin, rather than issue a fresh hot token which sole purpose is to serve as a payment token, you are not “issuing” a payment system. The “system”, if any, was already existing, and you had just tapped into it.

(That last paragraph is inspired by the “sufficient decentralization” proposal from William Hinman of the SEC.)

Tokens to the rescue!

In 2020, Malaysia’s securities regulator, the Securities Commission, promulgated a framework for companies to issue their own crypto.

This allows companies to pre-sell tokens, which could be used as payment in the future. This also helps resolve the cashflow problem for businesses, by allowing businesses to pre-sell tokens, which can then be redeemed by the token buyers for various items.

Malaysia’s legal framework allows the issuing tokens through an IEO.

It is quite likely that a token legally issued under an IEO, even if its sole purpose was to serve as payment, would not infringe the Payment Systems Act. That would be silly and would simply pit the Securities Commission against the central bank.

Tokens may be issued for purposes other than payment — we’ll cover that in a different article. For now, the payment angle will suffice.

For now, I would like to share my light-hearted poem which touches on the matter: “Old McDonald Fights Coronavirus“.

Conclusion – crypto for business

The coronavirus is a serious matter, and it’s going to be here for the next 2 years. Crypto can be helpful for businesses, but not every crypto is created equal. If you need some advice, please feel free to get in touch.

Important Notice

This article was prepared for general information purposes. If in doubt, kindly consult with a qualified lawyer. Also, references to any third party websites or services in this article are purely for purpose of reference and do not represent endorsement or condemnation.